While we’ve some formal American history study (e.g. older outdated “source” texts e.g. The Course of Mexican History Sherman, 93) real, independent statistical data for Mexican and U.S. Based Mexican Immigrant populations has become consistently available for the last half decade. Key sources include Mexico’s INEGI & U.S. based PEW Research. We’ve also referenced recent books and articles by independent journalists- a dangerous but heroic profession in Mexico- including Fredid Roman & Antonio de la Cruz, 2 of the 14 journalists killed in Mexico in 2022 alone.

Overall, while we serve all American working families and their communities from Canada through Mexico, our initial “beachhead” is specifically focused on the Mexican-born longterm U.S. workers and their families and communities in Mexico. They’re both the highest need but also the largest population segments, 7.8 of 11 million in the U.S. and 38.3 million in Mexico; the ones that will make greatest change in Mexico if economically (and thus politically) empowered.

We’ve included highlights specific to these segments below, while this data is now available, its seldom published or cited by major U.S. and Mexican media outlets, but we feel strongly that every American should have access to real information about this often misrepresented but important group.

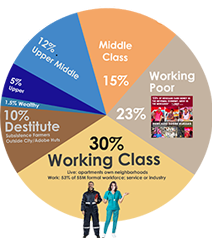

The Mexican government doesn’t even acknowledge the existence of their working class, publicly describing its population as “40% middle class, 60% poor”, blaming poverty on in-cash informal work.

But the data- straight from Mexico’s own statistics bureau INEGI- tells a much different story….

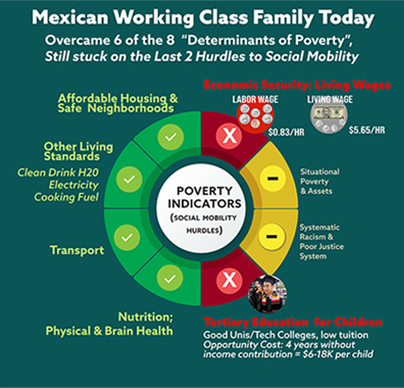

30% of Mexico’s population are formal workers1, but paid a government fixed wage of around $0.83 an hour. Even with both parents working a combined average of 150 hours a week, these families have been stuck at the poverty line for the last 50 years- but not destitute. They’re the Mexican Working Class. The current living wage for a family in Mexico is $5.65 an hour2.

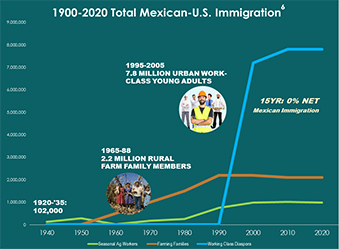

In the 1950s, 80% of Mexico’s population was rural, 77% of the labor market in agriculture. In the ‘60s, the government started transferring Billion$ of dollars -in cash, pesticides & automation equipment- to large farms to become export-only, destroying the domestic ag & ag labor markets, which today = 3% of GDP & 6% of employment, respectively. Subsequently, between 1965-1980 2.2 million from Mexican farming families crossed the U.S. border to look for work, while over 50 million moved with their rural communities to Mexico’s cities; 15% to urban edge- the subsistence farmers, 27% into urban slums-the informal workers in pink mercados, 58%, promised professional work, downtown settling into their own neighborhoods; the working class. But, after 2 government & bank-led national bankruptcies, and a decade of enduring 990% cumulative inflation with no increase in their wages- between 1995-2005 – working class parents & community patrons paid to bus 7.8 million of their young adult children north to work and send money back help keep them in their apartments and communities and out of the slums5.

Which brings us to:

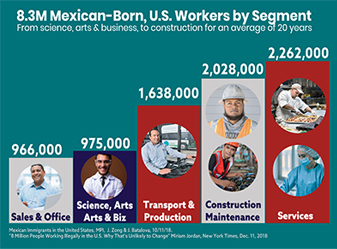

As of 2020, there are approximately 10.5 million Mexican Immigrants in the U.S.; the 7.8 million working-class diaspora have now been working in the U.S., for an average of 20 years.

Contemporary U.S. media and politicians (e.g. Trump admin) portray Mexican immigrants as “drug dealers, criminals, cartel members” which is sinfully inaccurate. The the working class diaspora were sent by their families and communities -who paid the $2000 for formal bussing, hotels, and initial housing to get them there- out of family obligation (Familismo), not personal motivation; 26% of them had already graduated college and planned to move into knowledge work, not do manual labor in the U.S. Even the Mexican government at the time introduced the “General Poblation Law” that both eliminated restrictions on undocumented emigrants while imposing strict bans on the return of workers from the U.S. to Mexico7 . The communities that they came from created the only successful force to keep drug gangs out of local neighborhoods, the Autodefensas, and are “the 32% hardcore (daily practicing) of the 81% Mexican Catholics today”8; they’re the honorable and ethical backbone of Mexico. Families in Mexico still depend on them so they work and keep a low profile, they’re not going to make waves defending themselves against misrepresentation.

They’ve been consistently employed for 2 decades, along with another 600K MX immigrants, 8.3 Million work today in industries ranging from from the sciences and arts, to sales and construction.

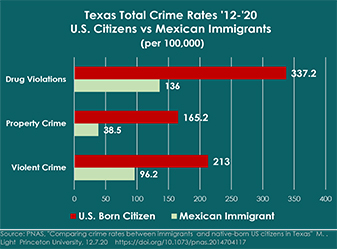

They’ve brought working class Catholic values with them. “Relative to Mexican immigrants, US-born citizens are over 2X more likely to be arrested for violent crimes, 2.5X more likely to be arrested for drug crimes, and over 4X more likely to be arrested for property crimes”

Once you have the real data behind who they are, what they do and contribute both to their families and the U.S. economy and how they behave... it becomes clear that this group are not just good Americans, but American heroes.

These Mexican born, U.S. workers send the majority of remittance to Mexico; $58.5 Billion in 2022 alone.

Just a few years ago, that number was $30 Billion; the same group just sending more to their families every month to offset the rising costs outside of the traditional banking system. While the long-term U.S. permmigrant has an average HH income of $51,00013, they’re still paid 12% less per hour than citizens14, they pay state & local taxes, and alt financial services already take 15-20% of their own money just to convert and use it. They can’t afford to keep doubling what they send home every few years.

But even with remittance income, working class families in Mexico can barely make ends meet. Apartments (& food) are the main fixed costs to provide a baseline quality of life for their kids and keep them out of the slums. The raised fixed labor wage is only $0.83 an hour and 31% still have to borrow from their communities every year. Aside from non-living wages, their other social mobility hurdle is tertiary school for their children, ave age: 15. For a family with no savings, the problem of college is opportunity cost of 4 years without contributory family income; $6-18K per child, domestic vs u.s. labor.

Unbanked, both parties still have to send and receive cash, why 96% of all U.S.-Mexico remits are still sent by traditional “MROs”. With this “captive audience” alt financial services continued to raise prices and by 2019, total costs for both sender and receiver already averaged 33% of money sent, thousands of dollars lost to Mexican families annually.

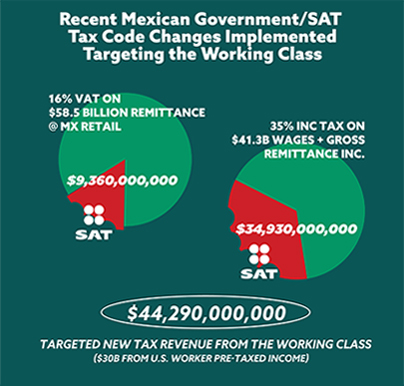

But just in the last few years the MX government, who always promised it would “never touch the poor’s remittances”, made 2 tax codes changes to take a major chunk of that life-supporting money from them:

1. In 2018, when remittances passed Mexico’s FDI, the government announced they’d “now be taxed as ordinary income” (35% rate).

2. June of 2021 the government implemented “Value Added Tax (16%) on non-resident providers of electronic or digital services” that “in addition to electronic services, also intermediation services for providers to Mexican consumers”14; which translates to the money stores & retail locations where almost everyone has to go to pick-up their remittance cash.

While filing taxes is avoidable (part of why MX working class is so bank averse; Banxico collected 90% or $138B in inc/vat taxes digitally in 2018)15. Of $58.5B remittance, $9.4B in VAT would be taken off the top, 16% before a remittee can receive their cash.

If the MX government gets its way, it will take $30 Billion from the People’s $58.5 Billion in family assistance; the same government that won’t pay those workers more than $1 an hour.

Its almost like the Mexican government wants to give its working class the option of either moving to the slums or sending their next generation north to labor and produce Billion$ more in tax revenue for Mexico instead of simply paying its workers a living wage so they send their kids to college to graduate to knowledge work and to the middle class, and one day retire from 150 hour weeks of hard-labor work.

As it is, Between 2010-20, 950,000 working class families that couldn’t keep up moved their families out of their apartments and communities and into the slums- no running water, no electricity, no Internet, no school bussing, no future.16

2. While the average age of working-class children in Mexico is 15, many are older, and ready to work. Pew Research cites a 0% net Mexican immigration rate for the last 15 years to 202017 (after the working class diaspora) but in 2021, over 600,000 young adult Mexicans were tracked bussing into the U.S.

We’re not against immigration among American states, but we are against forced emigration (government / economic compelled) out of homes and communities. One generation is enough.

So we start with these families, with Fondosis. A borderless money sharing and payment app; family funds stay in one shared pocket, from which local merchants in their community can be paid. A separate system for working class families and their communities, legal but outside traditional banking and neobanking systems. $1418 a month membership vs. the half dozen current services and fees, means $2000 (USD) more back into pockets of Mexican working class families. To save for their children’s futures.

As per socioeconomics expert, Michael Zweig, the defining characteristic and the greatest advantage of the working class today is their Community as a family of families: inter-community social and economic support and potential growth. The working poor, the middle class, and upper classes lack similar interdependent communities. So in Phase 2, we’ll move into community based products, which we’ll also open up to the 31% U.S.19 and 20% Canadian20 working class and their communities.

Sources:

1. Socioeconomics of Mexico (Several Sources):

2. Living Wage.

3. Worker Wages

4. Household Expenditures

5. Emigration, the Great Urban Migration, Migration

6. Total Mexican Immigration to U.S. 1900-2020.

7. Ley General de Población. (Translation) https://www.global-regulation.com/translation/mexico/560285/law-general-of-population.html

8. Pew Research, “A snapshot of Catholics in Mexico”, MICHAEL LIPKA, 2.10.16.

9. Data from U.S. Census Bureau 2010 and 2019 American Community Surveys (ACS), and Campbell J. Gibson and Kay Jung, “Historical Census Statistics on the Foreign-Born Population of the United States: 1850-2000” (Working Paper no. 81, U.S. Census Bureau, Washington, DC, February 2006).

10. Undocumented Immigrant’s State & Local Tax Contributions”, Institute of Taxation and Economic Policy (ITEP), L. Gee, pp 1-5, 3.17 “Undocumented Mexican Immigrants Pay More Taxes Than Wealthy” Eric Galatas, Public News Service, 3.28.17.

11. Money Mexican migrants send home up 13.4% in 2022″, Associated Press, 2.1.23

12. PNAS, “Comparing crime rates between undocumented immigrants, legal immigrants, and native-born US citizens in Texas”, Michael Light, J. He, and J. Robey, Princeton University, December 7, 2020

13. Migration Policy Institute, “Mexican Immigration in the United States”, Emma Israel and Jeanne Batalova, 11.5.2020.

14. PPIC, “Immigrants and the Labor Market”, Sarah Bohn and Eric Schiff, March 2011.

15. “SAT Reports Results of Tax Evasion Studies” Tax Administration Service, April 17, 2019.

16. Slums

17. “Pew Research. JULY 9, 2021, Before COVID-19, more Mexicans came to the U.S. than left for Mexico for the first time in years BY ANA GONZALEZ-BARRERA”

18. PEW, “What’s happening at the U.S.-Mexico border in 7 charts” JOHN GRAMLICH & ALISSA SCHELLER, NOVEMBER 9, 202.

19. Other name for community “loan club” in Mexico: cundinas. World Bank, “Expanding Financial Access for Mexico’s Poor and Supporting Economic Sustainability” APRIL 9, 2021.

20. “In 2018, 31% of Americans self-described themselves as working class”. Inc, Gallup (3 August 2018). “Looking Into What Americans Mean by “Working Class””. Gallup.com. Retrieved 2019-03-18.

21. Cardfus, “Canada’s New Working Class”, SEAN SPEER, SOSINA BEZU, RENZE NAUTA, SEPTEMBER 29, 2022